₦ | |

Plant and Machinery | 190000 |

Motor Vehicle | 170000 |

| Stock | 60000 |

Current Liabilities | 50000 |

Purchase consideration | 400000 |

The goodwill is

Options:A) ₦110,000

B) ₦30,000

C) ₦90,000

D) ₦80,000

Show Answer

Why are adjustments in the profit and loss account necessary?

Options:A) To cover some expenses of the following year

B) To show the provisions made during the year

C) To show the total expenses paid and income received during the year

D) To ascertain the actual expenses incurred and income earned during the year

Show Answer

In a petty cash book the imprest is ₦1380.

Expenses:

Stationery ₦350

Cleaning material ₦335

General expenses ₦265

How much was received to maintain the imprest at the ends of the month?

Options:A) ₦950

B) ₦970

C) ₦430

D) ₦380

Show Answer

A) profit and loss

B) revenue account

C) accumulated fund

D) income and expenditure acccount

Show Answer

Sule and Ahmed are in partnership sharing profit and losses equally. If Khadija is admitted as a new partner to take 1/5 th as her share. What is the new profit or loss sharing?

Options:A) Sule1/3, Ahmed1/3, Khadija 1/3

B) Sule1/3, Ahmed1/3, Khadija 1/3

C) Sule1/5, Ahmed1/5, Khadija3/5

D) Sule2/5, Ahmed1/5, Khadija2/5

Show Answer

A) a requisition form

B) an invoice

C) a customer advice

D) a credit advice

Show Answer

Use the following information to answer this question.

Provision for bad debt 1500

Additional information

1. Bad debt written off amount to 3000

2. Debtors balance as at the end of the year is 28,000

3. Provision for bad debts stand at 10%

How much is to be charged to profit and loss account as provision for bad debt?

Options:A) ₦2, 800

B) ₦1, 000

C) ₦2, 500

D) ₦3, 000

Show Answer

Dr. Sales Ledger Control Account . Cr

| ₦ | ₦ | ||

| Bal b/f | 3,250 | Bal b/f | 125 |

| Sales | 19,075 | Bank | 16,387.50 |

Dishonoured cheque | 625 | Discount | 862.50 |

Stopped cheque | 250 | Returns inwards | 325 |

| Bal c/d | 230 | Set off | 900 |

| Bal c/d | 4740 | ||

| 23430 | 23430 | ||

| Bal b/d | 4740 | Bal b/d | 230 |

The amount ₦19,075 represents

Options:A) the double entry for the total sales account

B) total sales for the month

C) credit sales

D) cash sales for the month

Show Answer

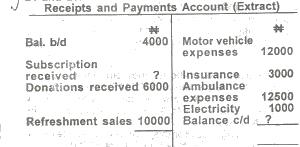

Subscriptions received are always put at 125% of the total donations received and refreshment sales.

What is the closing cash balance?

Options:A) ₦11500

B) ₦12000

C) ₦13000

D) ₦13500

Show Answer

Current assets are shown in the balance sheet in order of performance as

Options:A) debtors, stock, bank and cash

B) stock, debtors, bank and cash

C) stock, bank, debtors and cash

D) debtors, stock, cash and bank

Show Answer